PC shipments not expected to decline to pre-pandemic levels 'for at least 2-3 years'

Source: Daniel Rubino/Windows Cardinal

Source: Daniel Rubino/Windows Cardinal

What you need to know

- Gartner reports that 88.4M PCs shipped concluding quarter (-5% YoY), with 339.8M for all of 2022 (+9.ix% YoY).

- Demand for Google Chromebooks drove much of the quarterly pass up.

- Almanac PC shipment volumes are not expected to decline to pre-pandemic levels for at to the lowest degree 2-3 years.

- Post-pandemic, remote work, and "newly established ways of using PCs will remain regular practice."

Following the report from Canalys, Gartner is now confirming similar data regarding shipments of PCs from final quarter as well as the entire twelvemonth of 2022, which did amend than expected.

Source: Gartner

Source: Gartner

Gartner claims 88.iv 1000000 PCs were shipped in Q4 2022, a v% year-on-yr (YoY) decline, and Canalys pegged the number slightly higher at 91 one thousand thousand. For all of 2022, Gartner'southward study states 339.8 million PCs were shipped, which is very close to Canalys'due south 341 million.

Interestingly, Gartner suggests the reason for terminal quarter's decline was "pocket-size consumer demand" for the holiday flavor, simply likewise that the main driver was "the collapse in demand for Chromebooks." That theme of Chromebook demand severely crashing has been circulating since Q3 2022, when a decline of 29.eight% YoY was observed, a tendency that is apparently standing.

The rest of Gartner's analysis is quite interesting. While they note this new information "likely signifies the end of the massive and unexpected growth in PC need triggered by the pandemic," the decline "only slightly tempered the PC market's growth in 2022," which was overall positive with a nearly 10% YoY increment over 2022.

Additionally, also some slight weakening in need from consumers and severe drops in Chromebooks, it was supply-concatenation constraints that once more negatively affected the numbers and OEMs:

The U.Southward. PC market place saw its 2d consecutive quarter of double-digit decline during the 4th quarter of 2022, with shipments declining 24.2% twelvemonth-over-yr. This decrease was largely driven by weak Chromebook shipments equally demand from educational institutions continued to slow. While U.Southward. business PC sales were generally potent due to the recovering economy and the reopening of offices, supply chain delays impacted shipment volumes, especially in the large enterprise marketplace. The holiday season also saw weaker PC sales than in 2022 due to modest consumer need.

Those supply concatenation constraints are expected to abate it won't exist alleviated entirely until later on in the year.

Tiptop 3 (again): Lenovo, HP, and Dell

Source: Gartner

Source: Gartner

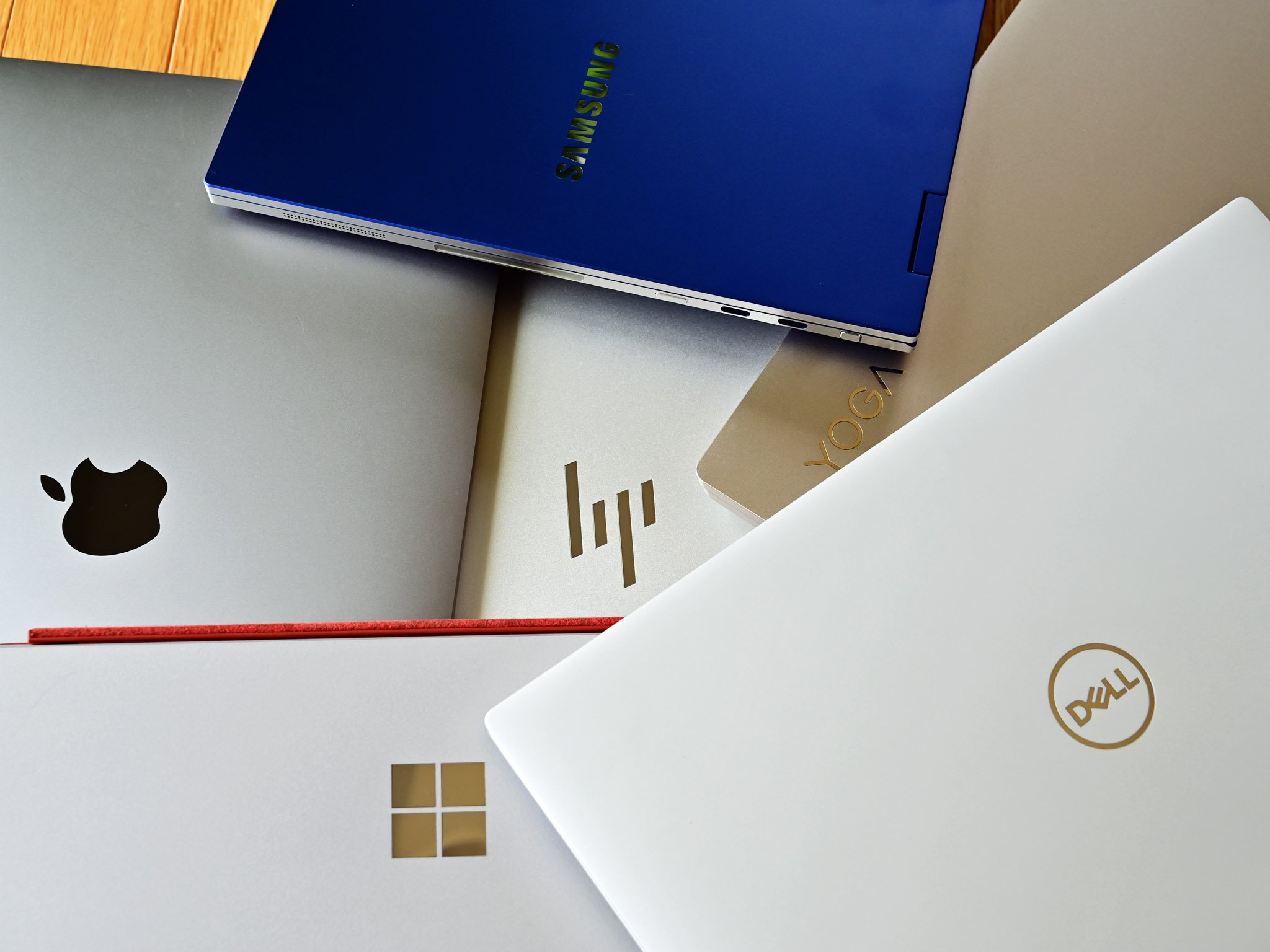

Breaking down by PC OEMs, Gartner has a similar ranking to Canalys in global PC shippers, with Lenovo in the top spot, followed by HP, Dell, Apple tree, and Acer.

Combining Lenovo, HP, Dell, and Acer, all four companies account for 72.7% of global PC shipments. That'south a slight increase from 71.viii% in 2022 with the same four.

Apple'southward PC shipments (not including iPads) accounted for 7.7% in 2022 and slightly increased from 6.9% in 2022.

Lenovo saw the about significant decline with a 12% drop for the fourth quarter of 2022 due to "slowed U.S. market, weak Chromebook need, and supply concatenation issues, which impeded Lenovo'due south ability to supply PCs to enterprise customers."

HP, past comparison, navigated the supply chain better with only a 4% YoY decline tempered by "robust growth in the Asia Pacific market."

Dell, again, is the objective winner reporting record revenue last quarter with $28.4 billion. It did the same for FYQ2 2022. Gartner's numbers reflect this, noting it gained market share "notching a fifth consecutive quarter of growth." Shipment volume exceeded 17 million units for the first time in the company'due south history.

Gartner also breaks down the numbers to the United states of america market, which varies from the global picture show. Dell is the peak shipper in the US, accounting for 28.5% of all PCs shipped concluding quarter, and HP was number two, Lenovo in third, and Apple tree in fourth.

Putting Dell, HP, Lenovo, and Acer together accounted for well-nigh 75% of all PCs shipped in the US for Q4 2022, down most five% YoY. Apple came in at 13%, upwardly from 9.two% YoY, reflecting the accurate perception that Macbook prevalence is college in us than the remainder of the world.

'Fundamentally changed … PC behavior'

HP Omen 45L (2022). Source: Daniel Rubino / Windows Central

HP Omen 45L (2022). Source: Daniel Rubino / Windows Central

Finally, for forecasting, things are still looking better than anticipated. While many saw the pandemic every bit a temporary blip, the consensus now seems that it profoundly contradistinct the market, resulting in the PC being more critical than ever.

Mikako Kitagawa, enquiry manager at Gartner, notes:

"The pandemic significantly inverse business concern and consumer PC user behavior, every bit people had to adopt to new ways of working and living. Post-pandemic, some of the newly established means of using PCs will remain regular practise, such as remote or hybrid workstyles, taking online courses and communicating with friends and family unit online."

Considering of this dramatic shift, Gartner expects the PC market place to slow "for at least the side by side two years," merely "annual shipment volumes are not expected to decline to pre-pandemic levels in that period." But as interestingly, few, if any, believe things will go back to the way they were. Remote work and the creator/gig economy are the new normal.

That slight decline in need makes sense every bit the PC market is very mature: Most people own at least one, though increasingly at least two PCs. But, like smartphones (also a flat marketplace), innovations around brandish engineering, including folding screens and new form factors, volition attempt to drive further adoption and increase those upgrade cycles. Things similar always connected 5G PCs are besides condign increasingly important (especially in the education organization), all of which should continue the PC market place humming for the foreseeable futurity, just not at the same rate as 2022-2021.

Shooty bang bang

Where are all the guns in Dying Low-cal ii?

It'southward by design, sure, only there's a distinct lack of firearms in Dying Light two. For better or worse, modern medieval Villedor is a identify to build your own weapons. But what happened to the guns and ammo and might information technology ever make a comeback?

Source: https://www.windowscentral.com/gartner-report-pc-q4-2021

Posted by: hooksthislem.blogspot.com

0 Response to "PC shipments not expected to decline to pre-pandemic levels 'for at least 2-3 years'"

Post a Comment